Bonds shine in another week of unprecedented events - European Fund Insights

/Historic Market Gyrations Take Some Wind out of the Recovery

In the week that the oil price turned negative for the first time in history, fund investors reduced their allocations to equity funds but continued to allocate to fixed income funds.

The price of oil, as measured by the futures contract for delivery of oil in May, turned negative as global demand for oil continued to fall and oil storage facilities began to run out of capacity. European investors reacted by reducing sales inflows into equity funds, which collectively recorded a net outflow of €705 million. Some investors sought to take advantage of the low oil price with energy-focused funds experiencing increased net sales relative to previous weeks. Although, a clearer indicator was the net sales of €545 million invested in oil ETFs.

The most popular product was the WisdomTree WTI Crude Oil ETF which saw net sales of €400 million in the week ended April 22. Although investors expect the price of oil to recover, the challenge of investing in oil during these historic times became apparent as that ETF product lost 30% in the same week.

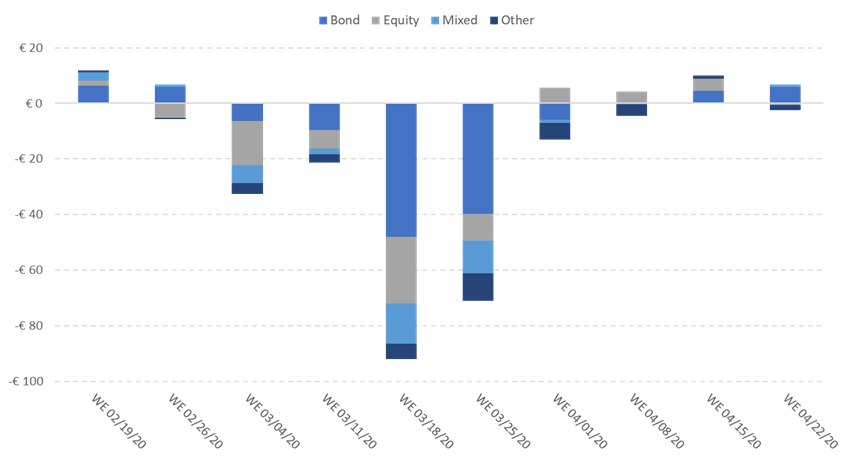

Figure 1: Bonds Shine in Another Week of Unprecedented Events (Weekly Data, In Billions of €)

*Data as at April 22nd 2020 sourced from ISS MI Simfund.

Sector Breakdown

Fixed income was the best-selling asset class in the week ended April 22 with €5.7 billion in net inflows. As indicated below, high yield, global, US dollar and euro bond strategies all saw inflows in excess of €1 billion. The equity sector/other category was once again the best-selling sector as investors continued to allocate to technology and healthcare funds and increased allocations to energy funds, which also feature in that categorisation.

Passive funds and ETFs followed the same trend as active funds with outflows from equities and inflows into bonds. European ETFs saw net inflows of €3 billion with sales into bond and commodity products offsetting a small outflow of €200 million from equity ETFs. Passive funds saw a net inflow of just €266 million as equity passive outflows virtually offset the inflows into bond passive funds.

*Tables do not add up to 100% due to some sectors being removed.

*Data as at April 22nd 2020 sourced from ISS MI Simfund.

Dividend Cuts and Investor Income Requirements

A major theme of the past 10 years has been investors’ requirement for income producing assets. However, many companies have cut or halted dividends either because of regulator and/or government pressure – banks - or a necessity to hold on to cash - insurance companies. This may lead investors to reduce allocations to equity income funds and seek other sources of income generating investments, most likely fixed income funds.

With this in mind, we note that net sales into bond funds were €5 billion in the week ended April 22. European equity income funds have not been adversely affected so far, although we will continue to monitor the relationship between dividend cuts and equity income fund flows.

For more information, please contact Plan For Life.