Research Alert: Coronavirus hits the European asset management industry

/Concern about the Coronavirus pandemic has caused life to change for millions of people around the world. As governments acted to contain the virus and businesses implement disaster continuity plans, equity markets in Europe experienced heavy losses—as of March 14th every equity market in Europe had declined by around 30% year-to-date. In what looks like a perfect storm scenario for investment managers across Europe, the most significant market downturn since 2008 coincided with staff being quarantined in their homes.

European governments have announced significant and far-reaching stimulus packages in order to mitigate economic and financial loss through the pandemic. The expectation that the pandemic will cause a consumer-led recession is addressed by fiscal and monetary policies directed at small businesses and households and not just the financial industry stimulus we have become used to in recent years. Mortgage holidays, business loans and government grants, amongst other measures, have been tabled.

The unique structure of the European asset management industry initially helped asset managers and then became a hindrance. The help came first; as Italy shut down, some Italian asset managers were able to rely on staff in their other European offices to continue servicing clients and manage funds. Then, as the pandemic picked up pace and European countries closed their borders, asset manager employees have been unable to go to work.

Redemptions Have So Far Been Manageable, but We Expect Them to Increase

The spectre of a world-wide recession, falling equity markets and a global pandemic have led investors to reconsider investment decisions. Although there is never a good time for a financial crisis, 2019 was a good year for the European industry with robust inflows and strong asset returns contributing to an increase in assets under management (AUM) of €1.6 trillion. At the end of 2019 European firms managed €10.7 trillion on behalf of their clients.

Using the weekly dataset within Simfund Global, we can provide further insight into AUM, sales flows and performance across the European asset management industry. This dataset tracks approximately 80% of European assets. At the beginning of the year AUM in this dataset was €8.3 trillion and had fallen to €7.5 trillion by March 11.

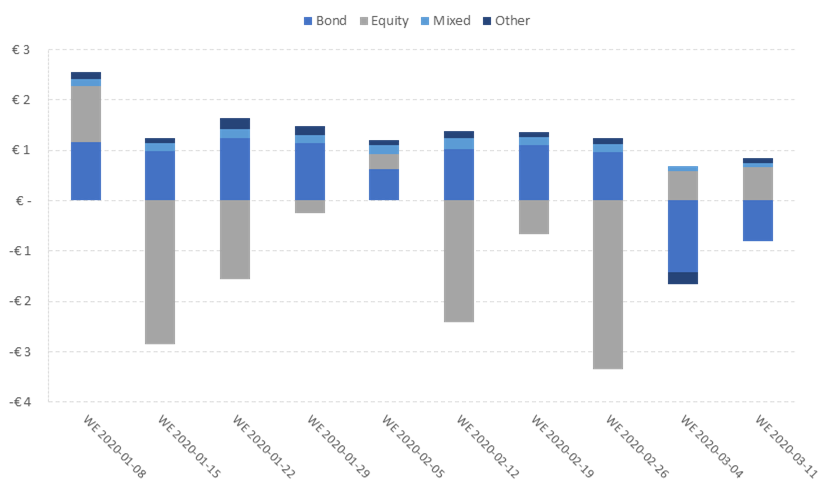

Net flows remain positive for the year but have turned negative since the pandemic impact hit financial markets. Year-to-date net sales stand at €13 billion due to strong sales in January and February mitigating the outflows seen in March. Up to March 11 bond funds recorded net sales of €25 billion, mixed asset funds saw inflows of €11 billion and equity funds an outflow of €21 billion. Figure 1 tracks the development of flows on a weekly basis this year.

Figure 1: European Net Sales Flow (Weekly Data, In Billions of €)

*Data as at March 13th 2020 sourced from ISS MI Simfund

Equity funds have borne the brunt of investor redemptions, particularly in the week ended March 4. But there are some bright spots; equity global, which has been a popular strategy for the past few years in Europe, saw a €3 billion outflow in the week ended March 4, although this is the only negative flow for the sector all year. In the week ending March 11, equity global funds saw a €1.6 billion inflow.

Bond funds have not experienced significant outflows, with certain categories bucking the net redemption trend. USD bond funds have taken in money each week this year, including during the recent weeks of severe equity market declines. Their tally was an inflow of €2.7 billion in the week ended March 4, and €5 billion in the week ended March 11. Meanwhile, high yield and emerging market bond funds have been the hardest hit among fixed income sectors; emerging market bond funds reported net outflows of €5.5 billion over the last two weeks and high yield funds a net outflow of €3.6 billion.

Passive Mutual Fund Investors Go Their Own Way

Passive mutual funds have exhibited a slightly different flow pattern. Equity passive funds saw most outflows in the weeks leading up to March but have seen a turnaround and positive inflows since.

Figure 2: European Passive Net Sales Flow (Weekly In Billions of €)

*Data as at March 13th 2020 sourced from ISS MI Simfund

ETFs, which have a much higher institutional investor base in Europe compared to the US or Canada, also saw strong sales in January and February at €13 billion and €5 billion, respectively. March was a different story as ETFs recorded an outflow of €7 billion leaving year-to-date net sales at €11 billion. Unsurprisingly, assets in European ETFs fell in February and March, by 4% and 11%, respectively, but remain positive over the year-to-date with a 10% increase.

Active Managers Provide Downside Protection

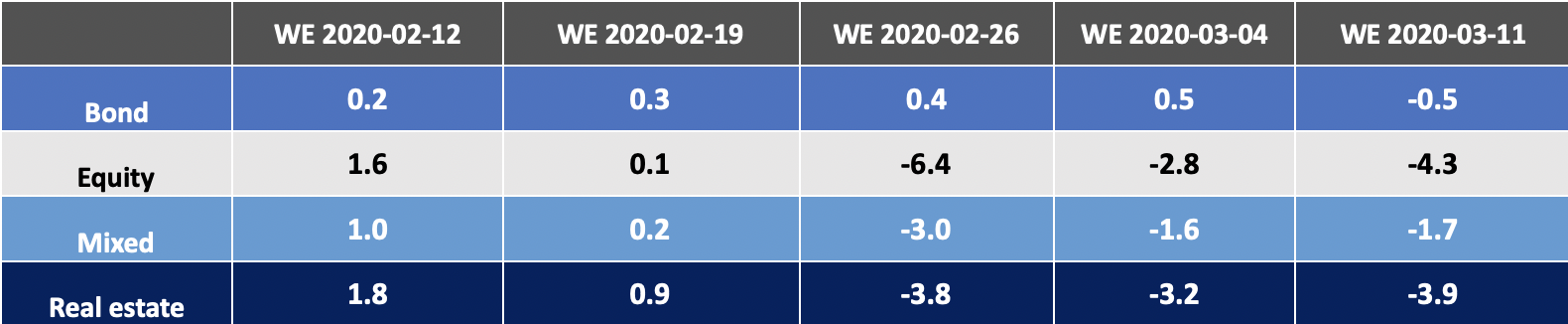

European funds have delivered respectable investment returns considering challenging market conditions. Figure 3 shows that even as equity markets have tumbled, funds have, on average, provided downside protection to investors. We will continue to monitor this trend to see to what extent alpha-pursuing managers are able to soften the market downturn for investors.

Figure 3: Average Fund Returns, Percentage In €

*Data as at March 13th 2020 sourced from ISS MI Simfund

The sharp fall in equity markets may mean that many fund investors have not had time to react and further redemptions may be processed this month and in coming months. The majority of European retail assets are invested through a financial adviser, and the advice process does not lend itself to reacting quickly.

We have already seen evidence of more liquid assets like gold being sold and, at the time of publication, bonds were beginning to sell off, following a few weeks of yields falling to record lows. However, we should bear in mind the size of the industry, a €10 billion outflow seems large, but represents just 0.1% of industry assets.

If you would like more information or more context or need assistance in understanding these volatile times please contact us.